If you are waiting for signs that the pandemic is over and produce life is returning to normal, look no further than the SEPC’s Southern Exposure. The event was booming! The return of corporate buyers made for record attendance and superhero attitudes for this Marvel-themed party… eh hem… trade show.

A quick note for those following inflation news, U.S. oil traded above $125 a barrel over the weekend. Crude oil prices are at their highest price since 2008 and are anticipated to climb further due to the war in Ukraine.

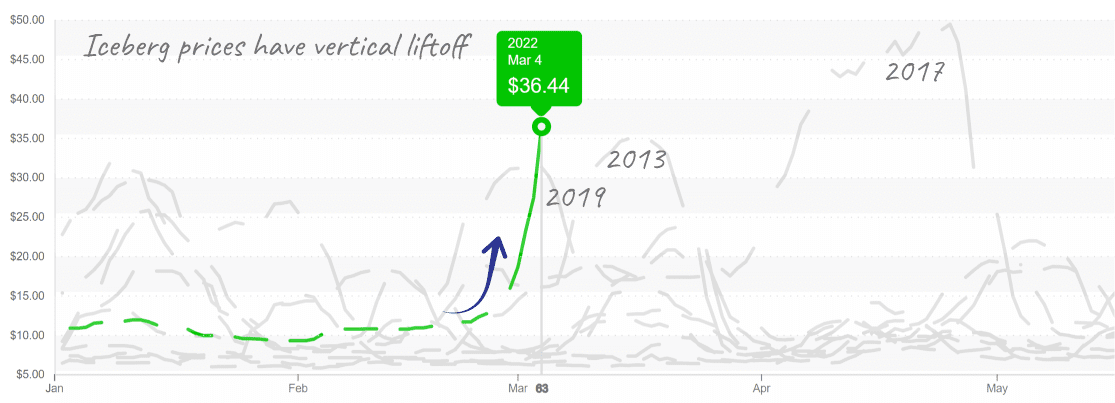

Cold and wet weather in the desert is tightening lettuce supply. Iceberg lettuce prices have more than tripled in seven days. Prices launched from $12 to $36 last week and are opening this week in the $40s. Cold weather has taken a toll on supply and most available product has ice-related impacts.

Romaine markets aren’t doing much better. Both iceberg and romaine prices are sky-rocketing! Markets will remain active for the next few weeks, that is, until lettuce production transitions northward in April. Desert volumes are a bit lower, and organic quality issues are forcing some buyers to return to conventional.

Iceberg lettuce ascends to a $40+ market starting today.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.00/pound, – 5.7 percent over prior week

Week #9, ending March 4th

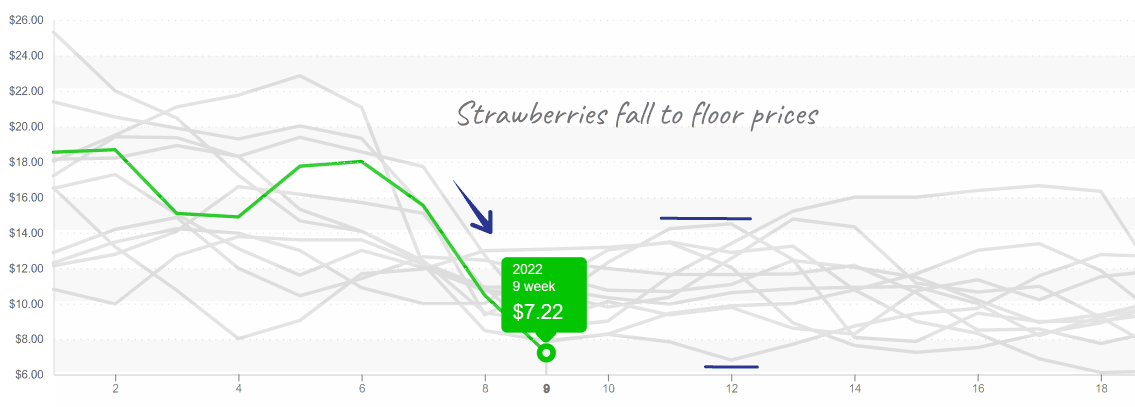

Berry markets are taking it on the chin. ProduceIQ’s Berry Index fell -15 percent this week. Plenty of reasons to promote berry volume!

Blueberry prices are at their floor price for this time of year, $11 crossing from Mexico. Importers are endeavoring to cut volume to stabilize markets. However, reports of quality issues out of South America may begin to boost prices in the coming weeks.

Raspberry prices continue their descent for the fourth straight week; $11 is far below their ten-year low for this time of year. Mexican import volume tumbled again, but not enough to halt sinking prices. Markets will stabilize in the next couple of weeks as supply adjusts to demand.

Defying inflation trends, strawberry prices are also at a ten-year low. Mexican and Florida’s volumes are going strong. During March, Florida’s crop will wind down, save a few fields that will stay online for buyers interested in local product. Cooler weather in Santa Maria may help elevate prices in the next couple of weeks.

Strawberries near their price floor, tempting some growers to shift from fresh to processing markets.

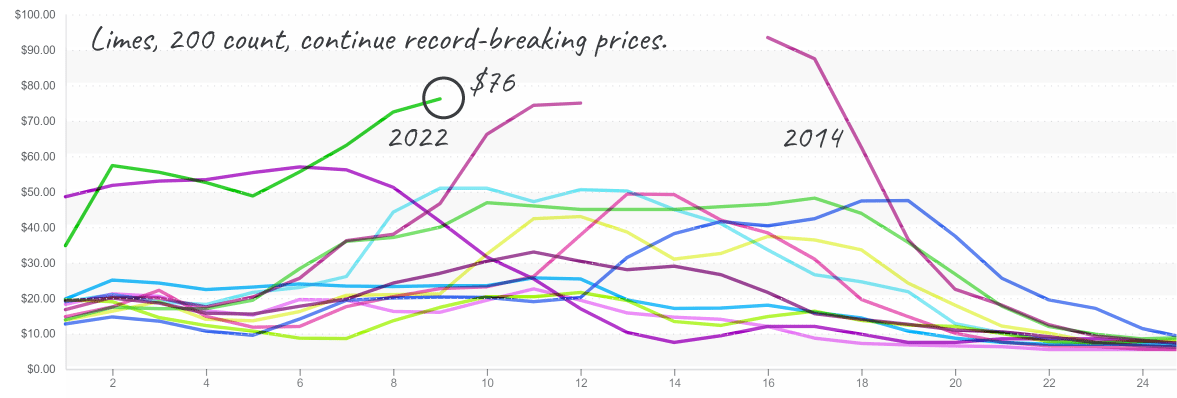

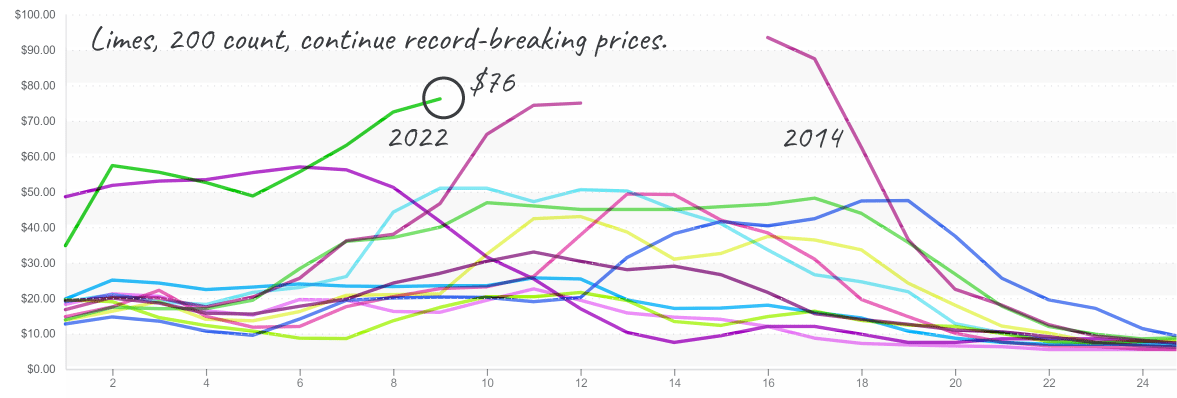

Rain in Mexico is delaying the lime market’s recovery. Buyers’ optimism for a return to normalcy has not materialized. Outside of 2014, lime prices are at an all-time high, currently in the $70s. The 2014 market prices didn’t collapse until the end of April.

In an average year, lime prices don’t generally decline until the beginning of April. Continued optimism exists for increasing larger size availability this month.

Lime prices are testing new highs, remaining above the $50s since January.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.