This is a four-part online series on financial statement basics adapted from a Credit and Finance feature in the July-August 2022 issue of Produce Blueprints. To read the entire issue online, click here.

The prominent balance sheet leverage or debt ratio is the debt-to-equity ratio.

This ratio determines what percentage of a business’ assets are owned by the company versus lending institutions.

The debt-to-equity ratio is computed by taking total debt and dividing by total equity.

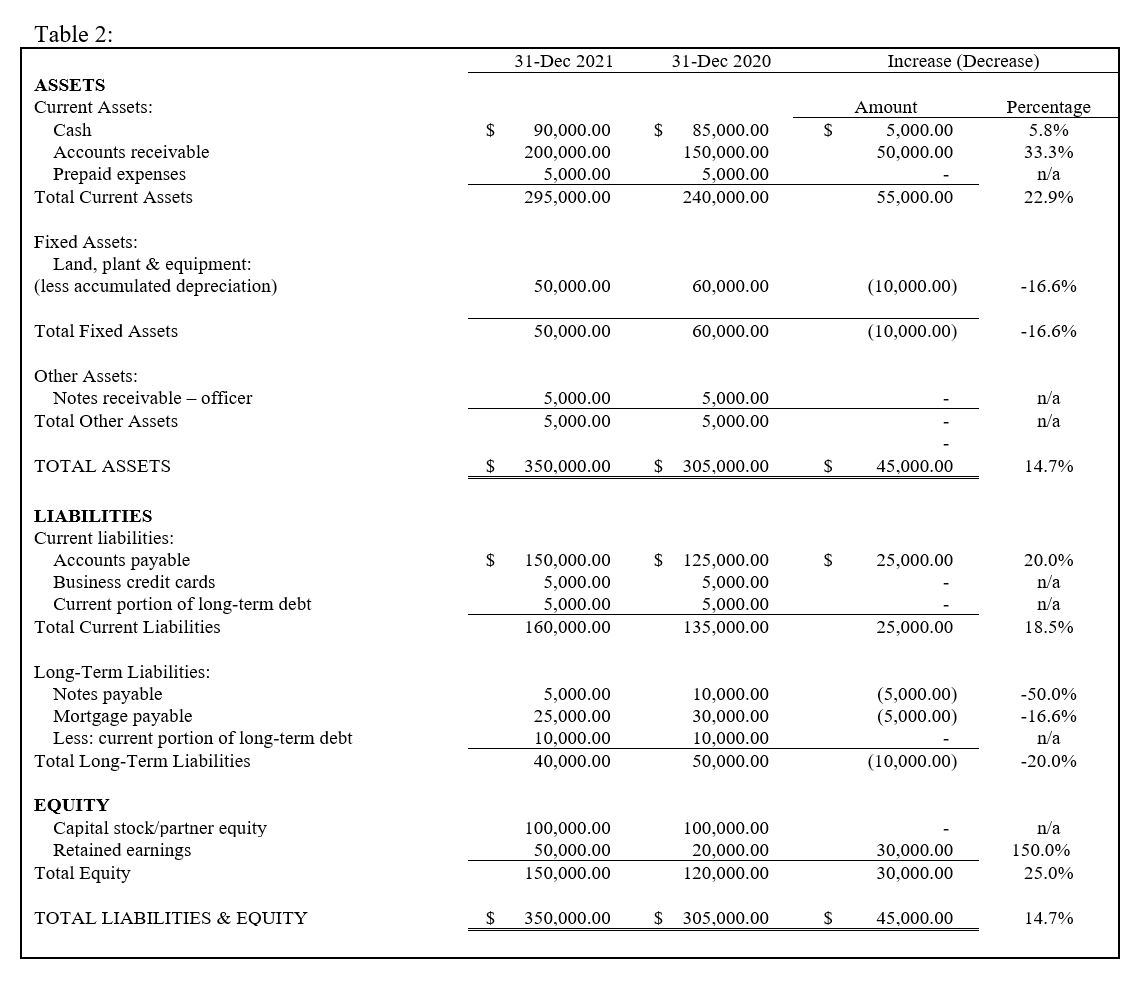

For the Table 2 balance sheet, the 2021 debt-to-equity ratio would be 1.33:1, or $200,000 over $150,000. This ratio shows that for every dollar of equity, the company has $1.33 of total debt.

How much is too much leverage? It comes down to historical performance and return on leveraged assets. And, from comparable viewpoint, understanding the industry and/or sector in which a company operates is useful as well.

A company that operates as a broker will likely have limited bank debt, while a wholesaler or repacker may have significant debt associated with and necessary for its operations.

The key to leverage is balancing current maturities and equity outpacing debt as a result of profitability.

CONCLUDING THOUGHTS

The operating partner mentioned in the introduction of this article picked up the necessary skillset to balance both sales and the company’s finances, and eventually bought out the investor.

The company continues to operate today and is quite successful.

Not everyone is fortunate enough to have a mentor.

As with many new startups, the investor believed that if the operating partner went it alone, sales wouldn’t have been a problem, but balancing sales with limited financial expertise might have written a very different story for the company.

For those who are operating a new company and may have limited financial experience, then this article should help. The importance of understanding a company’s financial position is critical to its success.

There are thousands of small businesses like the one mentioned here, where the combined efforts of an operating partner and a seasoned investor paid off. There are also thousands that failed due to financial mismanagement—don’t become a statistic because of financial illiteracy.