Organic produce is in a bit of a sales slump, and bell peppers are hot, but what market forces are behind these shifts in sales trends?

The United Fresh Produce Association BB #:145458 held its second webinar expanding on its quarterly FreshFacts on Retail Report, providing color to some of the quarter’s outstanding, or underwhelming, performers.

Easter threw a lot of numbers for a loop, said hosts Jeff Cady of Tops Friendly Markets BB #:103173 and Nielsen’s Matt Lally. The shift in timing for the holiday, coupled with supply issues in key crops, produced some unexpected results.

Cady said strawberries took a big hit from the holiday’s late timing, with California’s rain and little product available from Florida. But what was a loss for strawberries was a gain for mandarin oranges.

“Mandarins have become a pretty good Easter item,” Cady said. And the supplies and prices recovered from previous issues, so sales were way up.

Mandarins saw a 13.5% growth in dollars and 23.8% growth in volume compared to the second quarter of 2018, on a -8.3% drop in price.

Onions and bell peppers also have been trading sales and volume shifts. This year, onion dollars were up 15.1% on tight supplies, with volume flat, but bell peppers were up 5.6% in dollars and 5.8% in volume.

Retailers don’t sweat high onion markets, Cady said, because demand typically is inelastic.

“People need onions,” he said. “And oh, by the way, they’re still a good value. Yes, we raised the retail on them but you still need an onion. I don’t think people are chased away by higher prices.”

Salad kits also took over as the top packaged salad dollar share, at 27% in 2019 vs. 24.9% in 2018. Kits overtook lettuce and salad mix.

“I’ve been around over 30 years and I remember when that segment was basically Caesar salad,” Cady said. “We didn’t have much need for it. Now, every new item that gets presented to me in the salad category is in kit form.”

Organic sales shift

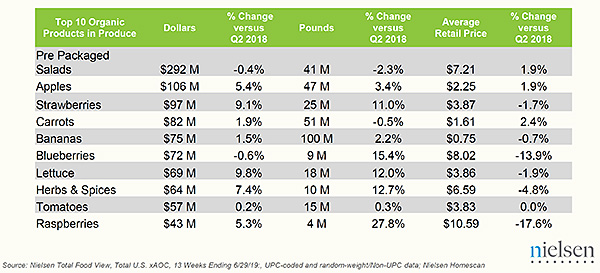

While five of the Top 10 organic produce items saw double-digit growth in volume in Q2, organic produce sales have slowed, Lally said.

“In the past several years it has been trending double-digits,” he said. “Now its down to 3.9%. to see it soften is definitely something worth looking into more and understanding.”

One needs only to look at the drop in average retail price to understand part of the problem. Average retail price of the Top 10 organic produce items was neutral or down for seven of 10 commodities. Only packaged salads, apples and carrots saw increases in average price.

Miss the webinar? United Fresh has the recordings of previous webinars available here.