From Vanguard International USA, Inc. BB #:300298 Issaquah, WA

Before we share our first grape crop update for the 2021-22 season from the South Africa we wanted to do a quick recap on the 2020-21 season.

The first grape estimate from last season was a bit conservative with estimates between 65 and 69 million cartons. Our season ended at 74.9 million cartons last year making it a record season in total volume. Needless to say, last year was a challenging one, with COVID-19 infections peaking at the end of 2020 followed by the container shortage and cyber-attacks both of which impacted the season significantly.

With last season behind us, there is renewed optimism and excitement around the quantity and quality of the new season ahead. We remain very aware of the global shipping and logistic challenges that still remain going into the 2021-22 season. We are learning to live with our “new normal” in the COVID-19 world and adhering to strict protocols in and around our growers’ packing facilities.

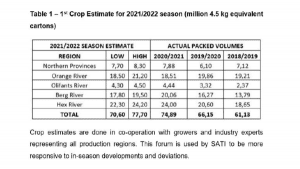

The first crop estimates for 2021-22 was just released with expected volumes between 70.6 and 77.7 million 4.2kg cartons. This is the 3rd consecutive season that we will see growth in the table grape industry even with a noted table grape hectare decrease of 1,234 hectares since 2019.

Similar to last year, we are experienced an excellent winter with much needed rain across the region including the rural areas of the Northern Cape that previously was drought stricken for 9 years.

The Orange river still had rain up to two weeks ago, which will be good for size on the earlier varieties like Early Sweet, Starlite, and Prime seedless. The long-term weather prediction is that rain in this area could be seen much later than normal. This predicted weather is pushing the crop back between 7 – 10 days and that means the Orange River will start with large volume in late November/early December.

Growers from all South African production areas are cautiously optimistic about the coming season are are paying extra close attention to the shipping woes and container shortages challenging exporters and other industry players. We know this is a very busy time for the ports and logistics as a whole as South African plums, apricots, peaches, blueberries, and cherries will all peak during December in the Western Cape, and they are all highly perishable. Just like grapes all these fruit types are growing in volumes year on year.

South African Grape Province By Province Breakdown

Northern Province – Groblersdal, Marble hall

This region made a very slow start to the season. We predict volume will start around week 46 supplying them for the first weeks until the Orange River region starts up. The Northern Province crop estimate is still on the rise after a few years of heavy rains in the middle of the season. There is some rain forecasted over the next 10 days, so we will keep a close eye on this. Size, quality, and condition of fruit in this region is looking positive.

Orange river

The Orange River region is trending a week later than normal. The earliest farms will commence at the end of week 47. The bulk of volume will start to be realized from week 49 which is the last week in November. Volume is still growing from this region with an estimate of approximately 20.5 million cartons for the season compared to the 18.5 million packed cartons from last season. Growers are happy with how things are progressing and even the rain from two weeks ago was welcomed as it will help with better size and more consistent berries. We expect to see more grapes than last year with the same quality and large sized grapes.

Olifants River

This area had a very good season last year for the first time in 4 years since the drought started. The industry finished last season by packing 4.44 million cartons, exceeding grower expectations. With little planned expansion this season estimates for 2021-22 are 4.3 – 4.5 million cartons. Dams in this region are full as a result of a great wet winter. All signs point to another strong season commencing in week 50/51 with Tawny and Flame varieties.

Berg River and Hex River

Crop estimates for these areas are on the conservative side after a very big crop last year. It is still early days in terms of bunch development. We will most likely see a correction in the figures in the second or third estimate going forward. Start-up dates could well be a week later than last year depending on the weather going forward but the expectation around quality and volume is very good.