With the growth of online grocery shopping, produce companies have a much bigger opportunity for brand marketing at affordable levels.

During the Produce Marketing Association BB #:153708 town hall webinar on Consumer Trends: Online Insights, August 18, industry leaders marketing trends are very much in produce companies’ favor when it comes to expanding sales through online retail channels.

“Online is infinite,” said Jonna Parker, principal, IRI Center for Excellence. “We can connect better, and we haven’t hit the tip of the iceberg.”

Advertising like CPG companies used to be so expensive using the old methods, she said, but online is different.

“With digital, it evens the playing field,” Parker said. While it’s still relatively expensive, “Now you can target [ads]. We can be brand marketers in a way we couldn’t before.”

Frances Dillard, vice president, brand and product marketing for Driscoll’s Inc. BB #:116044, Watsonville, CA, said her company has had success marketing online with retailers’ online shopping platforms.

“With better data and metrics, it’s been more effective to build the brand online,” she said.

Parker said a June IRI survey continues to show that perishables are behind several other food categories, but convenience remains the top motivator for shoppers to buy groceries online.

As for barriers to buying fresh produce online, it’s not price, but rather the consumers ability to choose their own fruits and vegetables and concerns about quality.

Dillard said with berries being so perishable, Driscoll’s has worked with retailers to keep the cold chain to keep quality up for consumers.

Kyle McWhirter, director of sales-emerging for Instacart, says the company knows the importance of the cold chain and also working with retailers to train order pickers to deliver high quality to get repeat business.

“Getting that right is central to our mission,” he said.

Instacart sales data shows that 50 percent of its customers buy fresh vegetables at least once a month, and 31 percent buy fresh fruit, so there has been success, but there remains a huge opportunity to improve.

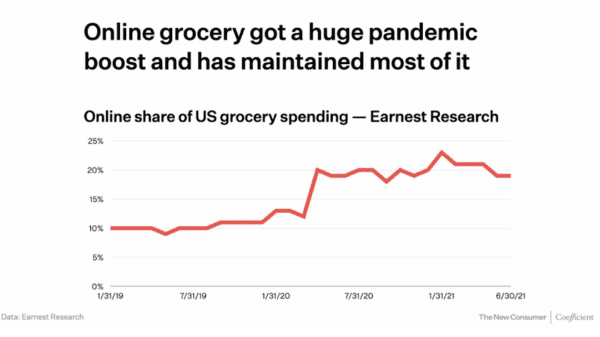

Online’s share of grocery spending went from about 10 percent until the pandemic started last spring, at which it rose to 20 percent, and it’s stayed close to that level since.