Citrus exporters to the U.S. are finding a hot market this summer as retail demand has been explosive during the pandemic.

For example, retail orange sales have been around 50 percent higher than last year from March through early July, but other citrus varieties have also seen strong demand since the pandemic began.

Now that many domestic supplies are running out, traditional summer citrus regions of South Africa, Australia and South America are sending product.

Paola Ochoa, program manager for Agtools Inc. said managing citrus crops across the world trying to reach the U.S. market involves the art of managing the trees at the farm level with proper harvesting times to reach ports at the right time.

Also understanding different competitive citrus countries and the East/West production and consumption are keys to success.

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

She said that understanding all growing regions is crucial to identifying the best quality products. Familiarity with the regions also facilitates short- and long-term projections and identification of new and innovative opportunities that help to make the supply chain that much stronger.

ORANGES: South Africa begins 2020 season to USA earlier than 2019 but later than 2018

In the case of navel oranges imported from South Africa we can see a very stable price, Ochoa said. This year the imports started a couple of days after they started in 2018, which was a year with a very strong start with prices above $30 dollars.

In 2019 the start of the imports began later in July, so we could consider this 2020 as an intermediate year between the two previous years in terms of the beginning of the imports into the USA market. Regarding prices, they have been very similar to previous years especially after the 4th of July.

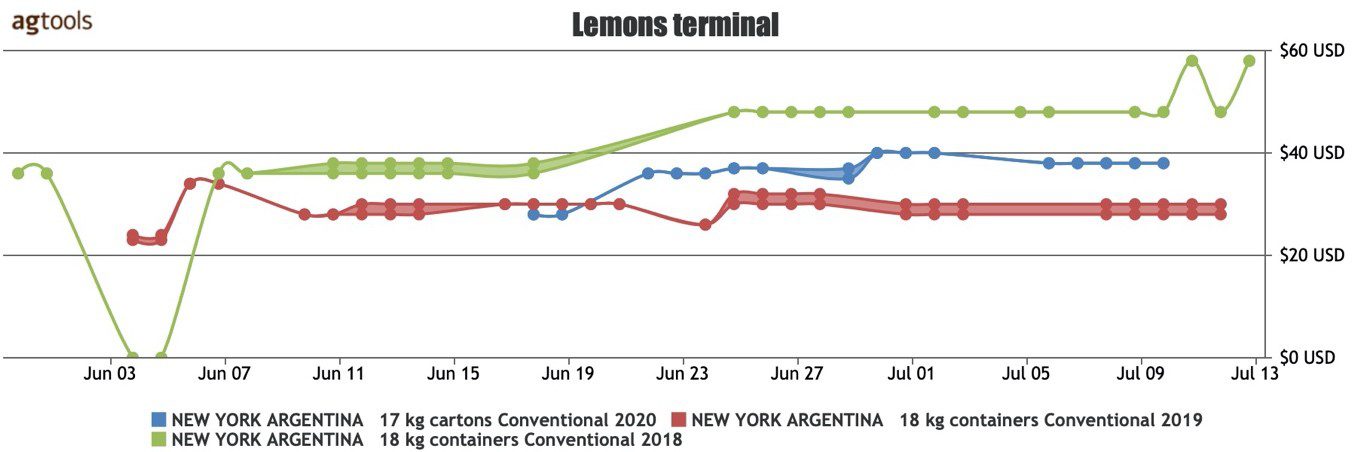

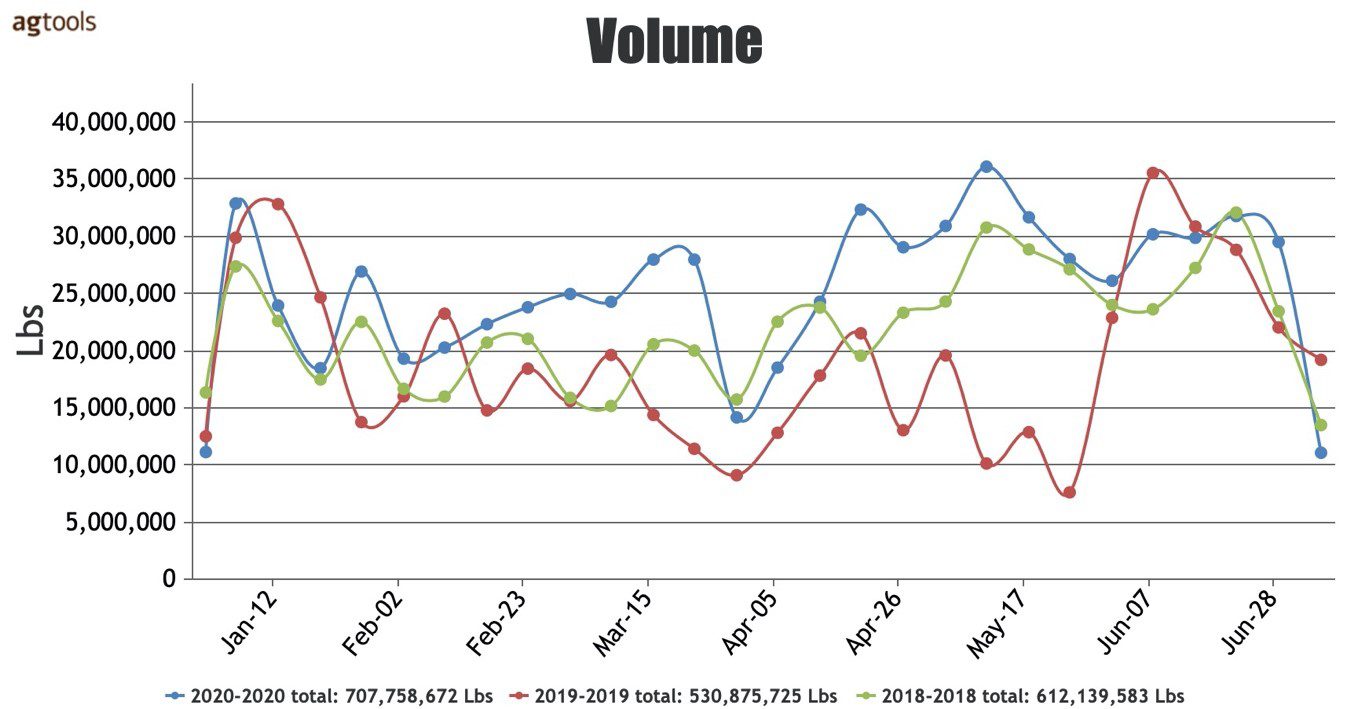

LEMONS: 2020 Argentine Lemon season starts late with better pricing than 2019

Lemons from Argentina accounted for 1.47 percent of the volume consumed in the U.S. in 2019, Ochoa said.

With a late start in 2020, pricing at New York terminal started reporting in mid-June. Covid-19 has not impacted the pricing, which is stable so far and higher than in 2019. Citrus consumption is driving stability in the region, she said.

LIMES: Mexico’s Growth

One Mexican commodity with strong growth is limes, Ochoa said. Limes which are used in the foodservice industry have found stability and growth regardless of the industry shift with many restaurants temporarily or permanently closed.

Limes’ volume behavior mirrors avocado from Mexico – more consumption and more consumers, she said.

Even with the restrictions and limitations that have been generated due to the pandemic issue, the export of limes from Mexico to the United States has increased by 33 percent compared to 2019 and 15 percent compared to 2018.